Great Questions from the Great Plains

The city of Bismarck, North Dakota, is struggling with how to pay for miles and miles of unproductive transportation investments. Of course, they are not looking at the issue of financial productivity -- how much money have we spent, what tax base has that created and what kind of return does that generate? -- but instead have confused their insolvency problem for a cash flow problem. There's just not enough money.

One way to deal with not having enough money is to simply tax people more. That's one option currently being debated by city officials:

As the Bismarck City Commission looks for $228 million to upkeep roads as well as build new ones, Mayor Mike Seminary has proposed placing a second penny sales tax question on the June 14 ballot.

Then, from the sidebar of the same piece:

Road revenue source options

• A second city sales tax of a penny per dollar would add $17.2 million for roads.

• Increasing the city's $19.1 million in property taxes by 90 percent could raise another $17.2 million for roads.

• Increasing all 21,000 residential and commercial utility bills $68 per month would raise $17.2 million per year.

• A local fuel tax, ranging from 72 cents to 98 cents per gallon, would raise $17.2 million.

• Instituting developer fees of $30,000 per lot would raise $17 million for arterial roads.

For the all-of-the-above voter, that's $86 million in new revenue for a $228 million problem. I just checked and $86 million is still substantially less than $228 million.

Last week I became aware of another group -- North Dakota Watchdog Network -- that has put forth ten questions they would like to see answered as part of this dialogue. I've given a couple of speeches in Bismarck and I know we have a lot of readers, and a few members there, so it gave me some pride to read these questions.

- Has Bismarck’s growth been “productive growth” or simply “growth at any cost”?

- Why hasn’t the growth Bismarck has experienced been able to pay for the public costs of the growth?

- Does the city realize that the need for higher taxes proves that the growth has not paid its own way?

- Why does the city have a “growth management plan” if it does not keep the public cost of growth below the revenue generated by the growth?

- Has the city devised a long-term policy to ensure that the costs of growth will not outweigh the benefits of growth if voters approve a tax increase?

- How will the city change its ways to ensure that the cost of growth does not exceed the benefits of growth in the future?

- What actions has the city taken to ensure that growth is at worst a revenue-neutral situation?

- Why should the current residents of Bismarck support growth if the growth is going to cost everybody more in taxes?

- If generating more revenue from visitors is the solution, why is that not enough with the sales taxes as they are today?

- How can the city prove that this tax increase will do the job?

Now I don't know anything about the North Dakota Watchdog Group. They may be far from Strong Towns thinking -- which is not reflexively anti-tax -- but, regardless, I'm happy to see these ideas inserted into the conversation. I hope policymakers take them seriously.

If they do, they will discover that the transportation investments they have been making -- which resemble the investments they are planning to make if they get more money -- are financial losers for the community. They create, at best, an illusion of wealth but are leaving Bismarck with enormous long term liabilities. It is the culmination of these liabilities that the city is now dealing with. More money to do more of the same will only make things worse.

A different approach -- a Strong Towns approach -- starts with asking and answering those questions, particularly the first two. When this is done, Bismarck will see that the problem they are trying to solve is actually insolvency, not cash flow. That realization will put them on the path to become a stronger place.

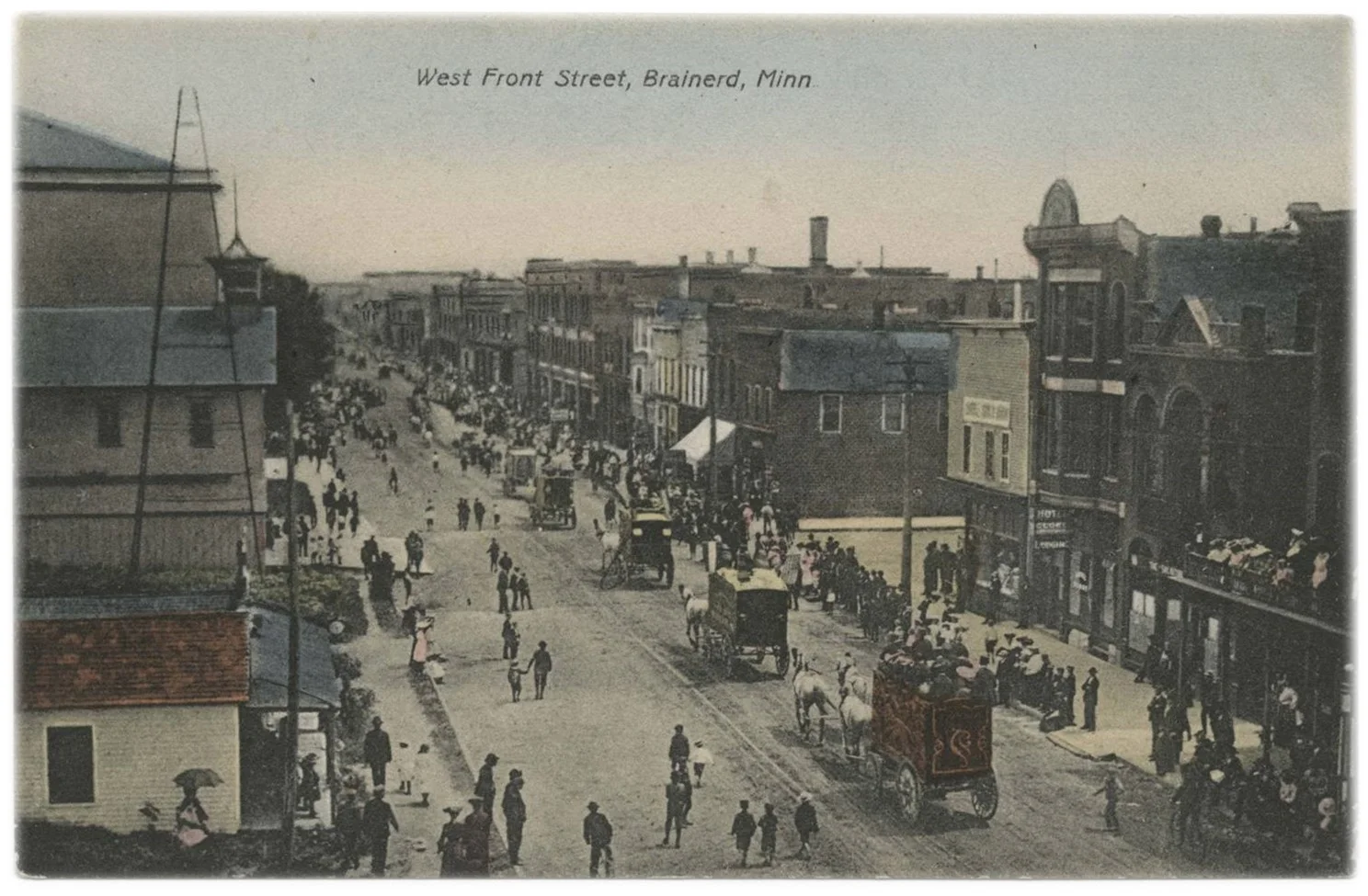

(Top photo from Wikimedia)