The Gentrification Paradox

Should we be more concerned with gentrification or widespread disinvestment?

A pair of recent articles on the controversial topic of gentrification have made headlines. First, the left-leaning publication Slate posted "The Myth of Gentrification" arguing that the urban phenomenon, while it does happen, is not the widespread scourge that hype would have us believe:

That gentrification displaces poor people of color by well-off white people is a claim so commonplace that most people accept it as a widespread fact of urban life. It’s not. Gentrification of this sort is actually exceedingly rare.

The second came from the more conservative-oriented Forbes which castigated fringes of the political spectrum in a manner I found eminently fair:

Two groups who I think share a lot of unappreciated similarities are liberal gentrification critics and conservative immigration critics. Both want to take a dynamic and free society and freeze it in time, because they like it how it is now. And both assume we have a high level of ownership over our neighborhoods and our country.

Gentrification has two critical elements. First, there is outside capital that flows into a neighborhood in the form of investments. Second, those investments ultimately result in the displacement of people who lived in the neighborhood before the investments were made. The presumption that one must equal the other is where I’ve tended to throw up my hands and walk away from nearly every discussion on the issue.

And because hang-wringing over gentrification tends to be both an urban and a liberal preoccupation (the issue barely registers in conservative circles outside of the nation’s capital), the proposed “solutions” to gentrification tend to involve market distorting interventions, regulations and subsidies. If I’m in a generous mood, I can respect the pragmatism of these approaches – fight a distorted market with more distortion – but I ultimately find the logic confusing, if not outright destructive.

“Strong Towns is unequivocally for more capital investment within our existing neighborhoods. This is fundamental to who we are as a movement.”

Strong Towns is unequivocally for more capital investment within our existing neighborhoods. This is fundamental to who we are as a movement. Not only do we believe these investments are critical to restoring the financial strength of our cities, we find that most efforts to suppress investment increase the fragility of our neighborhoods. Without an investment mechanism to renew and improve, these places have only one direction to go: down. Decline may be postponed, but it becomes inevitable.

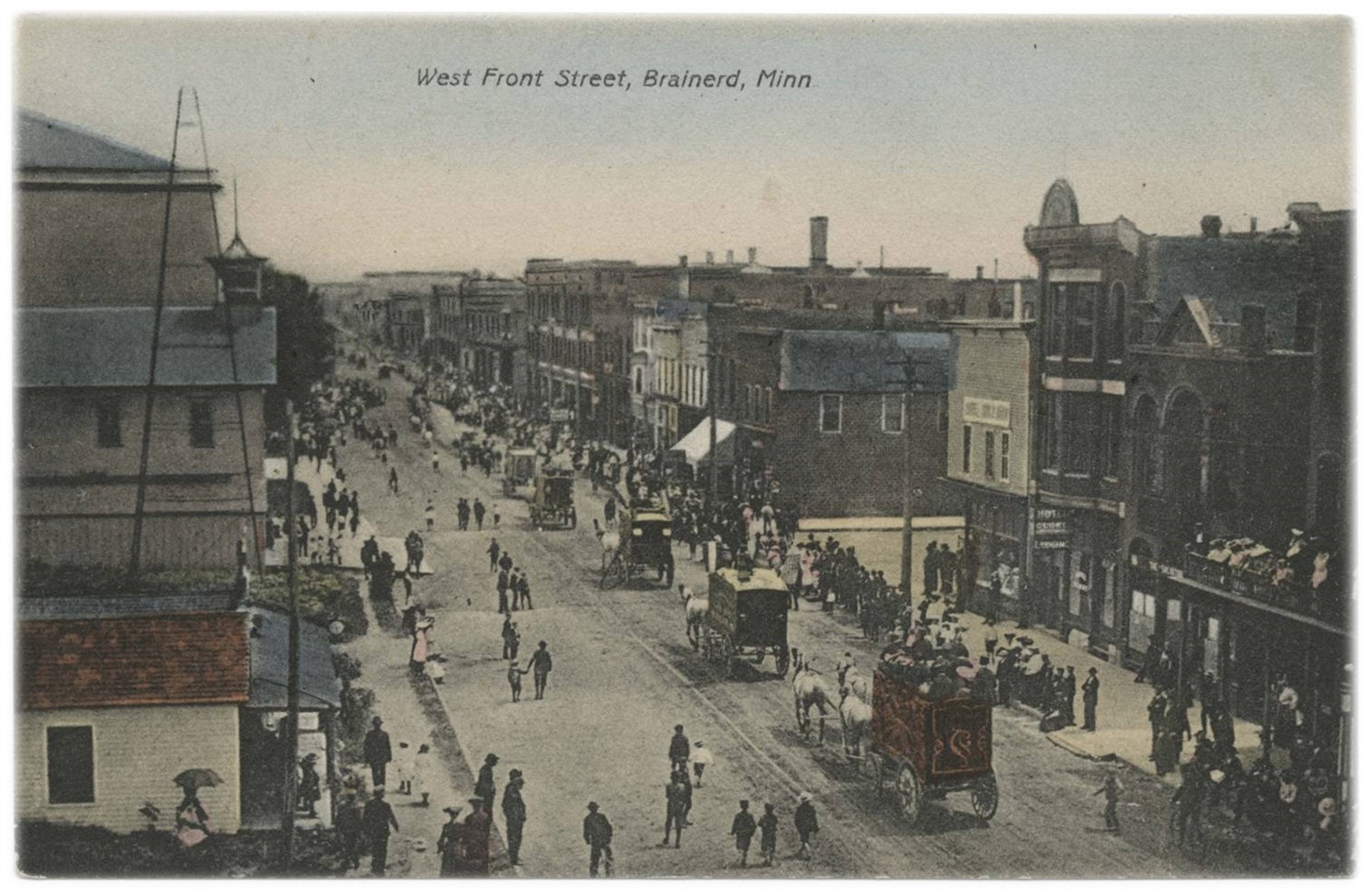

Does that make the second element of gentrification – displacement – inevitable as well? Perhaps. A lot of what I find myself doing these days is researching and then pondering how people handled this kind of thing before our Suburban Experiment—before centralized management of both our economy and, by extension, our development pattern. Trust me when I say that I struggle to resist the temptation to idealize those time periods – it was centuries of difficulty, for sure – and that I also fully understand that we’re not going back to that. What I’m attempting to do is gain some wisdom on how our cities can adapt today to become stronger.

What did they do that worked? Can we do that or something like that?

The pre-automobile development pattern was an organic process. It was both incremental and complex (see our article from last year, "The Complex City"). Gentrification – investment followed by displacement – was part of the natural order of things and, as with any organic system, it had a positive role in making things work for everyone.

Chaotic but smart. It wasn't perfect, but it also wasn't fragile, and there was a system for improving it over time.

The most dramatic thing America’s Suburban Experiment did was to invert the century’s-old paradigm of wealthy people living within the core of cities surrounded by poor people living on the periphery (like we still see in many cities of Europe, for example). Historically, the most expensive property was near the center of the city, and the poorer property on the edge. When America worked to empty its cities after World War II, we temporarily (and at enormous public expense) inverted this relationship — poorer people now lived in the core of cities which were surrounded by the more affluent — but we are in the process of restoring the traditional reality as the systems that created the inversion slowly fail.

Historically, without housing subsidies, rent controls, cooperatives and the like, poor people could purchase – in most cities – a modest place to live on the edge of the community. For small towns, this was the edge of the city. For larger cities, this might have been on the edge of a neighborhood center. Not only did this investment serve as shelter or a business front (or both), it was also a speculative investment. As the place become more and more successful – the good party, as we've referred to it – that prosperity would grow outward and, in a sense, consume (or displace) that poor person’s home.

As the city grew and more people showed up to live in that place, services would increase because the city could now afford to offer them (how novel). Prosperity would increase and the property owned by the poor person would become more valuable. In other words, that poor person would now have some real wealth.

He or she could then move further out and repeat the process – only this time with some starter-wealth – or, if things were going really well, the person could be the one to tear down the shack and build that two or three-story place that would last a generation or more. In other words, this system – however rough around the edges it might have been (and it definitely was) – allowed poor people to have some upward mobility and share in the growing prosperity.

Not a punchline but a reality for many.

A Way Forward

Could we do this today? We could, but we’d need to dramatically change many of our systems and, culturally, we’re going to be very resistant to that.

The first to go, or be seriously modified, would be building codes. Today, we don’t allow people to stake out their own spot with a modest investment in a small place that is only designed to last long enough to be torn down and replaced. In fact, this concept is offensive to many, but, historically, it was integral to giving people an accessible place to start.

We would also need to change our mortgage system. If you are a poor person today and are willing to take on a ton of debt, we’ll let you buy a home and make you an indentured servant to a Wall Street bank – a transaction subsidized in so many despicable ways by the federal government – while we encourage you to continually cash out your equity. What our mortgage and banking systems won’t allow you to do is to build a small house, something you could afford, while you work to pay it off and/or add on to it incrementally as your wealth grows. And in some states you can't even legally do a contract for deed.

Want to build that prototypical investment of the upstart: the business front with the home in back? In most cities, you’ll need to change your zoning code, likely over the objections of the neighborhood protectionists who fear the slow decline they experience less than the sudden change they don't.

Then you have the tax code itself which, at the federal level, gives you a larger tax break the more mortgage debt you take on (i.e. the more fragile you become) and at the local level punishes you with a higher property tax every time you improve your property (while subsidizing those who have the same utilities and services but choose to leave their property fallow).

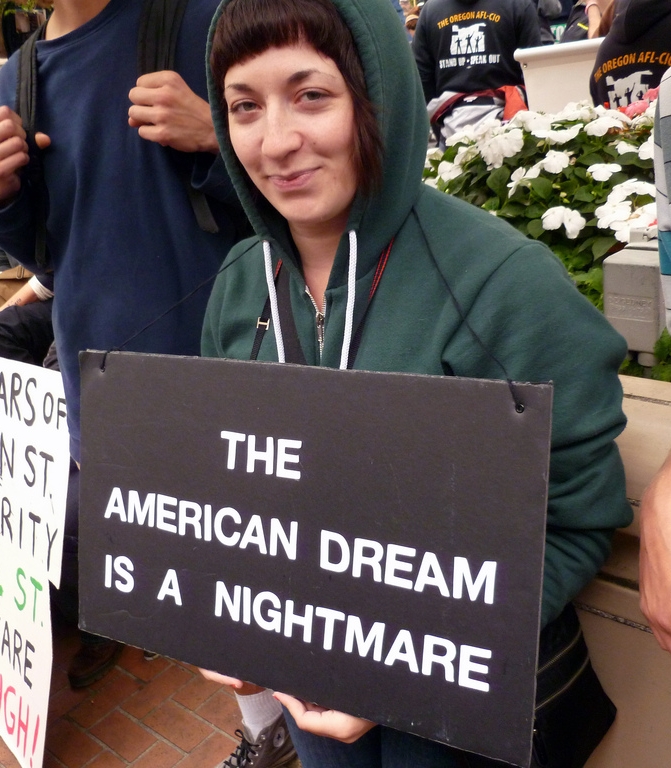

All of these regulations, incentives and subsidies have been put in place to ostensibly help the poor and the middle class participate in the American Dream. In this, we attempted to alleviate the messy and difficult situations that arise within all complex, organic systems. To remove all of those uncomfortable stresses that are necessary to optimize the infinite variables at play.

We took a system where gentrification was a positive force for wealth creation among the underprivileged and—under the guise of improving their situation—changed the system in a way that now primarily benefits the wealthy, where it benefits anyone at all.

The only way I can think of to deal with this situation is to fill the enormous demand for decent, urban places by increasing the supply. Fears of gentrification shouldn't slow quality urban development; they should accelerate it.

A 2020 study revealed that areas around streets named after Martin Luther King Jr. are more segregated and poorer than the United States average. Now, data shows property values in these areas are affected, as well.