Day 3: A World Class Transportation System

The Move MN coalition promised a transportation funding plan that would be comprehensive, balanced, gimmick-free and dedicated. Their proposal to marginally add to our transportation slush fund with some hidden taxes may be good politics, but it isn’t how you build a stronger Minnesota.

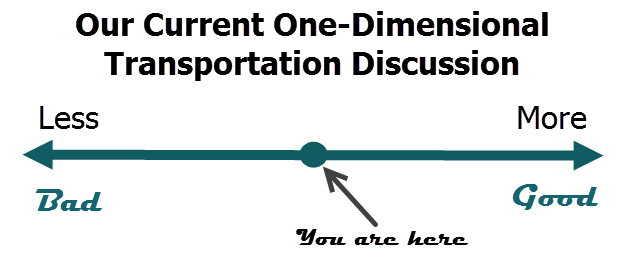

This past Monday, we explained how our “no retreat” mentality – where more transportation infrastructure is good and less is bad – has closed our eyes to alternatives that would cost less and produce better results. On Tuesday, we explained how that mentality developed, how funding a government-led transportation system with slush funds creates disconnect between supply and demand, one where governments actually have the perverse incentive to increase demand by adding to an already bloated supply.

This past Monday, we explained how our “no retreat” mentality – where more transportation infrastructure is good and less is bad – has closed our eyes to alternatives that would cost less and produce better results. On Tuesday, we explained how that mentality developed, how funding a government-led transportation system with slush funds creates disconnect between supply and demand, one where governments actually have the perverse incentive to increase demand by adding to an already bloated supply.

Minnesota is $50 billion short of the revenue it needs to have, in the words of our transportation commissioner, a “competitive, world class transportation system.” That is a staggering gap, one that even the most aggressive new funding proposals come nowhere near meeting. The Move MN proposal is neither aggressive nor new. It is a disappointing repackaging of old gimmicks, albeit with a larger megaphone. Minnesotans should be insulted by our leadership.

Today, less would actually be better. Imagine if we had half the lane miles we have today. Half the bridges. Half the interchanges. Half the turn lanes and traffic signals. Maybe we would have experienced less growth over the prior six decades – I would dispute that hypothetical conclusion – but it certainly wouldn’t have been half the amount of growth. No, there is much more to economic growth than simply transportation spending.

And if we hadn’t had all this government-led transportation investment, if we had only built half as much – done the obvious things like connecting major economic centers – then today we would have half the obligations with a tax base proportionately more up to the challenge. We would not be faced with overwhelming financial commitments and we would have far more options for adapting to an economy in transition.

Less is actually better.

Transitioning to a new approach means starting where we are today – in a terrible financial mess – and applying a new set of shared principles to get us where we want to be. I can’t pretend to speak for all Minnesotans, but if I were the transportation commissioner or were advising the governor/legislature on these issues, here are seven new operating principles that I would apply to help us deal with this crisis. These operating principles address the core financial problems of our current system and present a new way of looking at transportation funding that, I believe, could be understood and accepted by most Minnesotans.

1. A financial mechanism that balances supply and demand is an essential component of any transportation funding approach.

2. Risk belongs primarily in the private sector. We should not gamble with communal resources.

3. Where public investments are made, they must follow, and be proportionate to, productive private investments.

4. Communal wealth must not be appropriated for individual gain.

5. The more complex and nuanced the impact of a transportation project, the more local the funding mechanisms and design decisions must be.

6. Where statewide slush funds are used to fund transportation investments, there must be intensive and ongoing accounting to monitor the financial return-on-investment.

7. In the absence of sufficient communal revenue to meet all communal obligations, priority must be given to transportation projects that providing the greatest statewide financial benefit.

Our transportation system must be designed to build the wealth, and enhance the prosperity, of all Minnesotans. These seven operating principles should be added to the safety and mobility goals of Mn/DOT as mechanisms to achieve those broader goals consistently over time.

To elaborate:

1. A financial mechanism that balances supply and demand is an essential component of any transportation funding approach.

This principle addresses the primary cause of financial imbalance: the lack of a pricing mechanism that balances supply and demand. While I’m going to write tomorrow about how we implement these principles, for those of you that are going to jump the gun and assume I mean privatize the road network or toll all roads (as some blowhard commenter on Streetsblog did), you would be wrong. At the end of the day, however, there needs to be a price that people pay directly that expresses the real dollar value they put on transportation infrastructure.

2. Risk belongs primarily in the private sector. We should not gamble with communal resources.

“Communal resources” is my way of saying “tax dollars” while clinging to the notion that this money represents all of us coming together to accomplish something. Gas taxes are incredibly regressive, as are licensing fees. If we are going to use these sources of revenue – and I think we should continue to do so – we should hold ourselves to the strictest standard of prudence.

We need the private sector to take the bulk of the risks in today’s economy. (Note that I also believe private risk takers should be rewarded greatly when their risks pay off.) This isn’t to say that there is no room for risk taking within government (see our Neighborhoods First report for an example), but not in the area of transportation where we are massively overbuilt. For transportation projects, the only real risks we should be taking are small experiments to figure out how to make better use of our current investments.

3. Where public investments are made, they must follow, and be proportionate to, productive private investments.

Build-it-and-they-will-come is a great movie plot. It is also a sure path to insolvency for governments. Minnesota needs to make strategic investments in transportation infrastructure, but only in support of productive private investments. A productive private investment is one that generates more revenue for the government than it creates in service burden. When we invest in productive places, the wealth of our state grows. When we take resources from our productive places and use them to subsidize unproductive places, we are performing a public disservice.

And while our public investments must follow productive private investment – in a sense, be secured from risk – they must also be proportionate to the private investment. We should not be building multi-million dollar interchanges, for example, with all of the accompanying frontage roads and signals, just to serve a big box store that is moving up the highway (see Highway 15 near St. Cloud for one recent example, among many).

4. Communal wealth must not be appropriated for individual gain.

When taxpayers are called on to collectively make an investment in transportation and that investment disproportionately increases the property values (wealth) of an individual or corporation, that value needs to be captured to pay for the investment. State-funded transportation is a public good, not a lottery or – worse – corporate welfare.

Mn/DOT likes to pretend they are not in the land development business, yet they take actions every day specifically to facilitate land development. Without measuring and capturing these gains, we continue to make dumb investments. We need to become savvier.

5. The more complex and nuanced the impact of a transportation project, the more local the funding mechanisms and design decisions must be.

The relationship between transportation and land use is incredibly complex and nuanced. For decades, transportation funds have come along with standards and mandates that are blind to this complexity and nuance. These funds overwhelm local budgets and induce local officials to undertake projects they don’t fully support or believe are best for their communities, diverting resources from more worthy efforts in the process. We need to give local governments the ability – and the responsibility – to undertake and fund local transportation improvements in the way best suited for their community.

6. Where statewide slush funds are used to fund transportation investments, there must be intensive and ongoing accounting to monitor the financial return-on-investment.

We have largely convinced ourselves that transportation spending creates jobs, opportunity and wealth for Minnesotans. Does it? This is a testable hypothesis where we can generate and obtain plenty of data, yet we don’t. Why?

If we were deliberative about collecting and analyzing financial data relating to our transportation investments, we would learn what the best investments are and, most importantly, how to build our state’s collective wealth. If we are going to tax everyone and use that money as an “investment” for common good, we need to get serious about measuring the return on that investment.

7. In the absence of sufficient communal revenue to meet all communal obligations, priority must be given to transportation projects providing the greatest statewide financial benefit.

We are being forced to do triage on our transportation infrastructure. The triage process should be a focused effort to improve the financial health of the state. Spreading out resources in a completely political process where everyone “gets their share” will guarantee that many high-returning projects are short-changed. Minnesota needs to focus on growing our resources incrementally over time, the only way to truly improve our capacity to serve our people.

Tomorrow I will describe, with a series of actions and policy changes, some ways we can apply these principles to bring about a financially productive transportation system and a strong, healthy Minnesota.

Coming Up:

- Thursday: Specific proposals for funding and operating a modern transportation system.

- Friday: Winners, losers and why it matters.

These thoughts are going to be part of a broader report on transportation and mobility that we are planning to release this year. If you’d like to be kept in the loop on that project, consider becoming a member of Strong Towns. And if you’d like to support this effort, we’re looking for partners that want to make a financial contribution to bring the Strong Towns message of transportation reform to their city or state. Contact our Executive Director, Jim Kumon. to find out how you can make that happen.