The Highest Return on Investment for your City is not Where you Think

Consider the two following investment options for your personal portfolio:

Option A: Invest in a handful of very large entities. Each comes with a lot of hype yet has a track record of under performing, even dramatically losing money. A look at peer entities shows a consistent track record of failure and decline over time.

Option B: Invest in an expansive portfolio of hundreds to thousands of small to mid-sized entities. None of these have much hype or prestige associated with them. While collectively they have a consistent track record of success, individual entities within the portfolio may be a spectacular boom or a total failure.

This metaphor comes from an article we wrote in January and it’s an apt description of the current choice our nation faces, only it's not being framed as a choice. We're told the federal government is going to spend $1 trillion on infrastructure—i.e. invest in some very large corporations and some very large projects, but we at Strong Towns know that those have a low return on investment and often a negative impact on our communities. We've found time and again that Option B, the smaller scale investments, produce far better returns and cost far less.

Let’s recap the main flaws in the idea that we can spend $1 trillion on infrastructure in order to improve our country. Then let’s talk about a better plan that will actually offer long-term gains for everyone, for far less than $1 trillion.

How Federal Infrastructure Spending Makes Cities Poorer

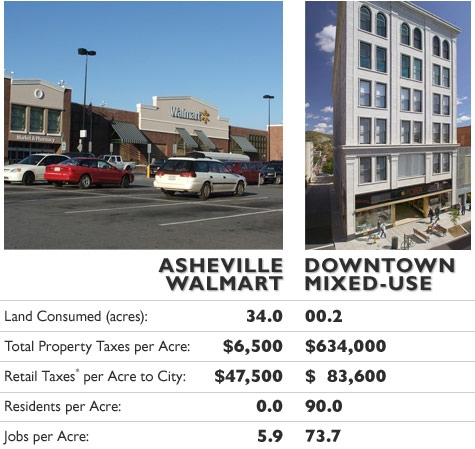

Federal infrastructure spending tends to make cities poorer not wealthier because, while the federal government may pay the initial cost to build a new highway or bridge, it’s local governments that take on the long-term maintenance liabilities, often going into enormous amounts of debt to do so. We’ve also seen time and again the way that federal infrastructure money goes to some of the least productive types of development — like suburban housing and inner city highways — blinding local governments to small-scale investments that have the potential to be far more financially beneficial.

Source: Urban3 and Strong Towns

It's not just the federal government that's misguided in its belief in extensive infrastructure spending. Macroeconomists also tend to misunderstand the impact of infrastructure spending on local communities. Spending on infrastructure is seen as the consequence-free way to boost the economy, but in city after city that we visit across the country, that’s not the case. For local governments, infrastructure is a liability that weighs on a city’s budget with the promise of expensive maintenance costs down the road, even though it’s usually counted as an asset on municipal balance sheets.

Growth—building new infrastructure, new homes, new businesses—is not sufficient to improve a local economy or indeed, the United States economy as a whole. We need productive growth in order to achieve true prosperity. Our investments must pay for themselves and add to our communal wealth. We’re talking real concrete return on investment, not just social benefit or “time savings” (which is so often used to justify road construction and expansion projects). There’s nothing wrong with counting social benefits, but those don’t pay the bills. An infrastructure project that has no long-term plan to cover its costs is doomed to fail.

But perhaps the biggest macroeconomics mistake that is costing our cities dearly is the fact that infrastructure investments are not something we can walk away from. While the federal government can sponsor a project, hold a ribbon cutting, then move on to the next project, cities can’t do that. Our cities are stuck with the consequences of these decisions for decades. That dangerously wide road funded through federal dollars will make life unsafe, even fatal, for the people in the surrounding neighborhood. That big box store with frontage roads and turn lanes that were created through federal money will leave a vacant hole that contributes nothing to its town in a decade or two, with acres of public infrastructure suddenly serving no purpose.

It's Time to Invest in Something Different

Rather than spending billions of dollars on large infrastructure projects, we should be focusing our investments in the most high-returning areas of our town: the poorest neighborhoods.

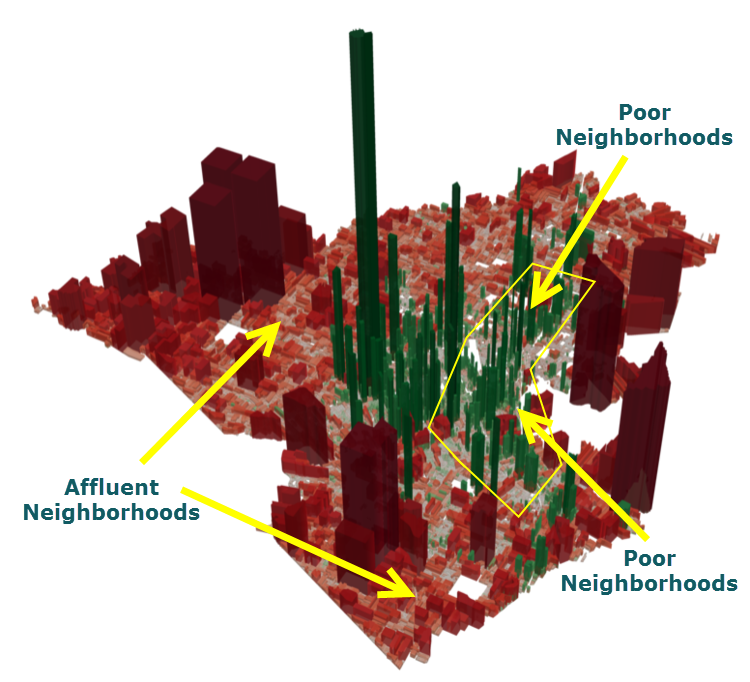

It might be counter-intuitive but take a look at this map of tax value per acre, created in partnership with Urban3. Green equals profit and red equals loss. The higher the block goes, the larger the amount of profit/loss.

Source: Urban3

This is Lafayette, LA but this map looks like most towns in America. Strong Towns president, Chuck Marohn, described this phenomenon in January 2017:

The poor neighborhoods are profitable while the affluent neighborhoods are not. Throughout the poor neighborhoods, the city is, today, bringing in more revenue than they will spend to maintain the neighborhood, and that's assuming they actually invest the money to maintain the neighborhood (which they have not been doing). If they fail to maintain the neighborhood, the profit margins will be even higher.

This might strike some of you as surprising, yet it is important to understand that it is a consistent feature we see revealed in city after city after city all over North America. Poor neighborhoods subsidize the affluent; it is a ubiquitous condition of the American development pattern.

In a presentation at the 2017 Strong Towns Summit, Jason Roberts, co-founder of the Better Block organization discusses high returning, small-scale investments you can make in your city.

Chuck continues with examples of some of the affordable, small-scale investments we could make if we wanted to boost the returns in these neighborhoods:

We're talking about things like putting in street trees, painting crosswalks, patching sidewalks, and making changes to zoning regulations to provide more flexibility for neighborhood businesses, accessory apartments and parking. If we try some things and they don't work, we don't lose much because they don't cost much. We learn from our small failures and try something else.

We’ve shared some other great examples of these types of small-scale investments whose values are being tested and proven across the nation in places like Memphis, TN, Oswego, NY, and Pittsburgh, PA. Low-cost investments in the neighborhoods that need them the most? Seems like a no-brainer.

Wrap-Up

So, to summarize:

- Don’t shell out billions in federal infrastructure money. It will just sink our cities into debt with additional maintenance liabilities we can’t afford to take on.

- Instead, make small investments in the highest-returning areas—the poor, neglected neighborhoods of our cities.

Federal infrastructure spending is a huge, expensive gamble that we already know doesn’t pay off. Strong Towns' proposal for a path forward is cheap, and it offers high upside potential with low downside potential. The choice should be clear.

(Top photo source: Dox Txob)

Rachel Quednau serves as Program Director at Strong Towns. Trained in dialogue facilitation and mediation, she is devoted to building understanding across lines of difference. Previously, Rachel worked for several organizations fighting to end homelessness and promote safe, affordable housing at the federal and local levels. Rachel also served as Content Manager for Strong Towns from 2015-2018. A native Minnesotan and honorary Wisconsinite, Rachel received a Masters in Religion, Ethics, and Politics from Harvard Divinity School and a Certificate in Conflict Transformation from the Boston Theological Interreligious Consortium, both in 2020. She currently lives in Milwaukee, Wisconsin, with her husband and young son. One of her favorite ways to get to know a new city is by going for a walk in it.