Recommended Reading: The Oil Drum

When we are delivering the Curbside Chat presentation, one of the most eye-opening parts for people is when we go through the concept of the Growth Ponzi Scheme. While there is a degree of abstraction with the concept that I originally feared might pass over the audiences, I have been pleasantly surprised that most people immediately get it. The "it" is this: Our entire economic system is based on an assumption of never-ending, always-accelerating growth.

Of course, this assumption is tragically wrong. One of the things we describe in the Curbside Chat is how our economy, in an effort to maintain the Ponzi Scheme, shifted in the 1970's/80's from a layaway approach to a credit approach. We've spent our savings, today's earnings and now tomorrow's earnings propping up this financially unsustainable lifestyle. Anyone with a pencil and a ruler can show you how this is not going to end well.

One of the blogs I read fairly routinely is The Oil Drum, a site that deals with the implications of a tightening energy supply. Here is how they describe themselves:

The Oil Drum's mission is to facilitate civil, evidence-based discussions about energy and its impact on our future.

We near the point where new oil production cannot keep up with increased energy demand and the depletion of older oil fields, resulting in a decline of total world oil production. Because we are increasingly dependent upon petroleum, declining production has the potential to disrupt our lives through much higher prices and fuel shortages. The extent of the impact of this supply shortfall will depend on its timing, the magnitude of production decline rates, the feasibility of petroleum alternatives, and our ability to curtail energy consumption.

They have had a couple of extra-fascinating posts recently on this topic of the need for growth inherent in our system. On September 17 they posted EROI, Insidious Feedbacks, and the End of Economic Growth, where they correlate our rates of economic growth with the cost and supply of energy.

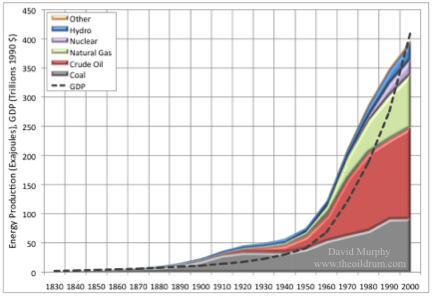

Economic growth over the past 200 years has correlated highly with energy consumption (Figure 1). Even more telling, since 1970, 50% of the year on year change in GDP in the U.S. is explained by the year on year change in oil consumption alone (Figure 2). This is important because oil consumption per se is rarely used by neoclassical economists as a means of explaining economic growth.

Figure 1. Energy production and GDP for the world from 1830 to 2000.

Figure 1. Energy production and GDP for the world from 1830 to 2000.

They point out that times of economic expansion have correlated with times of low oil prices, while times of contraction have included the converse. In other words, economic growth in our current model requires cheap energy. This is obvious to anyone with a 45-minute commute from the suburbs -- or anyone who builds and sells them homes -- if they stop to think about it.

Yesterday The Oil Drum posted Systematic Risk Arising from a Financial System that Requires Growth in a World with a Limited Oil Supply, which explained in non-alarmist terms how that, even if the oil is there, if it is more expensive to extract it is going to cause all kinds of problems for our economy. These problems are directly related to the fact that we have placed huge bets in the present on massive rates of growth in the future.

Our current economic system includes a huge amount of debt. Money is loaned into existence. Debt is used to finance many business expansions. Governments rely heavily on debt.

The US economy has been growing for many years, with only brief interruptions, so nearly all of our experience with borrowing money, and paying it back with interest, has been during periods of economic growth.

Borrowing from the future is relatively easy when the economy is growing, because when the time comes to pay back the debt, the debtor’s economic condition is likely to be as good as it was when the loan was taken out, and may even be better. So defaults are relatively uncommon, and the growth in the economy between the time the loan was taken out and the time it is repaid provides some contribution toward the interest payments.

But what if we start encountering a very different kind of world, one with a decline in oil supplies? If oil resources constrain economic growth, debt defaults can be expected to rise, and the whole debt system underlying our financial system is at risk. Insurance companies are very much at risk too, because many of their assets are bonds. In the past, these bonds would have been repaid with interest, but in a world with little economic growth, and perhaps economic decline, the risk of default becomes much higher.

Even if we should discover a way around our problems—say a new technology, which permits more oil extraction at lower cost, or a better substitute for oil, financial institutions--including insurance companies--are still likely to encounter substantial systemic risk related to debt defaults in the next few years.

We have not put ourselves into a very strong, resilient position by being fully leveraged, dependent on growth to pay back that debt and, at the same time, dependent on cheap energy to attain that growth. It is not likely we will ride a virtuous wave of low energy costs and high growth rates that will allow us to pay back these debts. In fact, if we did catch such a wave, our system would have us then place even bigger bets on the future.

That is the nature of a Ponzi scheme.

If you include The Oil Drum in your regular reading list, you'll grow to understand why our towns and neighborhoods need to quit the Ponzi scheme and start building Strong Towns.

The Strong Towns Blog; It's like reading Jim Kunstler, except you can share it with your mom. Sign up for a Curbside Chat, our project to bring the Strong Towns message to towns and neighborhoods across America. You can also join us on Facebook and Twitter.