The cost of auto orientation, update

The Taco John’s versus the “old and blighted” story is one of the most compelling that we share in our Curbside Chat. Here you have two blocks that are identical in every way, except one: the pattern of development. They are the same size, the same shape, abut the same thoroughfare, adjoin the same neighborhood and have the same amount of public infrastructure investment. Only a block separates them and so it is truly an apples-to-apples comparison.

The old and blighted block is a remnant of the incremental, historical development pattern. It represents one of the first increments of growth that cities experienced on their periphery; a small investment in a pop up box. This is the cheapest, credible investment that someone could have made in a commercial property here in my hometown back in 1920. In their comprehensive plan, the city has indicated that this block is a redevelopment opportunity that would, to use their language, ultimately become “auto oriented”.

The old and blighted block is a remnant of the incremental, historical development pattern. It represents one of the first increments of growth that cities experienced on their periphery; a small investment in a pop up box. This is the cheapest, credible investment that someone could have made in a commercial property here in my hometown back in 1920. In their comprehensive plan, the city has indicated that this block is a redevelopment opportunity that would, to use their language, ultimately become “auto oriented”.

This is exactly what happened two blocks, which used to look like the “old and blighted” block but now contains a new Taco John’s. Definitely auto-oriented with a large off-street parking lot, two drive through lanes, a large sign and a setback/orientation consistent with highway development. If we are to believe the city’s planning documents, this entire corridor will someday transform into a collection of buildings of similar design and orientation.

It is the math that makes this such a compelling story. While we are predisposed to favor the new over the old, and we discount the value of those “blighted” properties, looking at the numbers sets us straight. In this case, that run down block that the city and others would like to see replaced is actually 41% more valuable than the brand new Taco John’s. In a property tax system like we have here in Brainerd, that means the city gets 41% more taxes from the old and blighted block than it is getting from the exact same sized block with the brand new drive through restaurant. (And in a sales tax system, the difference is likely to be the same, although the perverse incentives of such systems tend to dominate).

In the investment world, that would be called an opportunity. We can see in that old and blighted block an asset that is clearly undervalued by the current paradigm. The city discounts that asset and works to undermine it in favor of the auto oriented asset that they value more. This is true even though the latter returns less, and that is completely ignoring the cost of the 26 years’ worth of tax subsidy (yes, you read that correctly). This city invested 26 years of subsidy payments to get a property that, in the year 2033, will pay substantially less than what it replaced.

And that assumes the drive through restaurant holds its value. Let’s examine that assumption.

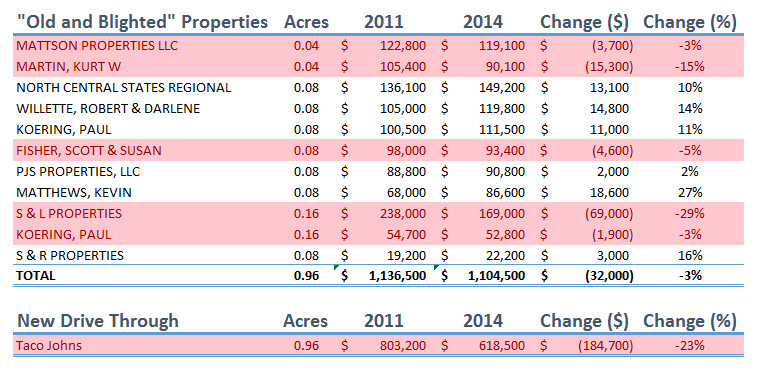

The original analysis of the Taco John’s block versus the “old and blighted” block used property valuation data publicly available from the Crow Wing County Assessor. This is the value that is used to compute the amount of tax these properties pay to the city (before removing the subsidy, in the case of the Taco John’s). We did the analysis in 2011 using the numbers posted at that time. Three years later, they have been updated to reflect changes in the market. Here’s what we now find.

There are eleven properties on the “old and blighted” block. In the three years since we last looked, five of them have lost value while six of them have increased in value. The net is a $32,000 decline, which is a 3% loss from the starting value. Given the market conditions, that’s a pretty stable block.

That stability is in sharp contrast to what has happened at the Taco John’s. In that same period of time, it has lost $184,700 in value, a full 23%. The prospects for success in the year 2033 aren’t looking that great at the moment.

And it should be noted that, even if there were no tax subsidy to the Taco John’s, the city would be collecting 79% more taxes from that old, run down, blighted block than they are collecting from the shiny new investment up the street that they worked so hard to get.

This is not an anomaly. The traditional development pattern – the way our ancestors, worldwide, built places for thousands of years – has enormous financial productivity and resiliency. This approach creates more real wealth for the community, pays more taxes per foot and holds its value in good times and in bad far better than anything we’ve built in our new, auto-oriented experiment.

And thus the opportunity. How much more valuable could that “old and blighted” block be – and remember, it is already outperforming its competition – how much more valuable could it be if we actually played to its strengths? What if the highway out of in front of it didn’t make it terrorizing to park there? What if we slowed down those cars and made it so people could cross it on foot or bike? What if there were some shade trees for people who walked the block and went to these businesses? What if the lighting were scaled for people and not a highway interchange? What if it was easy and comfortable for the people from the adjacent neighborhood to walk or bike here? What if there was a bike rack? What if we swept the sidewalk?

Instead of systematically devaluing our city, instead of spending our money on things that aren’t paying back, there are a ton of small, affordable things that could be done to improve the value of our asset that are already outperforming other assets we are spending millions on. These opportunities are everywhere, we just need to start seeing them.