But Rich People Live Here, So We Can't Be Going Broke!

One of the most pernicious things about easy credit is not simply that it allows us to live beyond our means, but that it readily tricks us into believing we're not doing so.

You can max out your credit cards filling your home and your life with nice things—a big-screen TV, a remodeled kitchen, a brand new car. And then you get to live day after day surrounded by those things. And a funny thing happens: you start to feel wealthy because you're surrounded by trappings of wealth. A sort of circular reasoning sets in, at the gut level if not the cognitive level:

"I have all this nice stuff, so obviously I was able to afford it. And because I was able to afford it, it's not a problem that I have it. Nothing to worry about."

This is the Illusion of Wealth. Communities that have maxed out their proverbial credit cards experience a similar illusion. And it manifests itself routinely in the illogic with which some civic officials and boosters respond to our observations about the fiscal hole they're in.

Some common objections to the observation that a place has built an unsustainable amount of public infrastructure are:

"Well, it might be unsustainable for a poorer community, but we're doing well over here, so we can afford a little extravagance."

"We're a growing, desirable community, so the debt is an investment in our future."

"We need to spend this money to keep up with our population growth."

It may be true that you'll be able to pay it all back. But the mere fact of growth isn't evidence that you will be fine. That's a circular argument, just like the fact that you just bought a big-screen TV is not actually proof that your personal finances are ship-shape.

Relying on the fact that you've been able to build some shiny new stuff and attract some rich taxpayers to live in your city is a bad bet to stake your future solvency on. Here's why:

1. Many rich neighborhoods don't stay rich forever.

If you're going to talk about private wealth as the reason you can splurge on public infrastructure and amenities, you need to remember that private wealth can up and move. From a municipal government's perspective, wealthy residents are not so much like the indebted homeowner in the analogy that led off this essay—he knows he's fine putting that BMW on credit because he just got a promotion at work. Wealthy residents are more like the bling—the car, the TV, the kitchen—because cities can, in a sense, "buy" them, and cities can also lose them.

High-income individuals who have a choice of where to live may flock to a community with good schools, nice new modern houses, roads with no potholes, attractive landscaping: the trappings of the illusion of wealth. They can just as easily flock elsewhere a generation down the line.

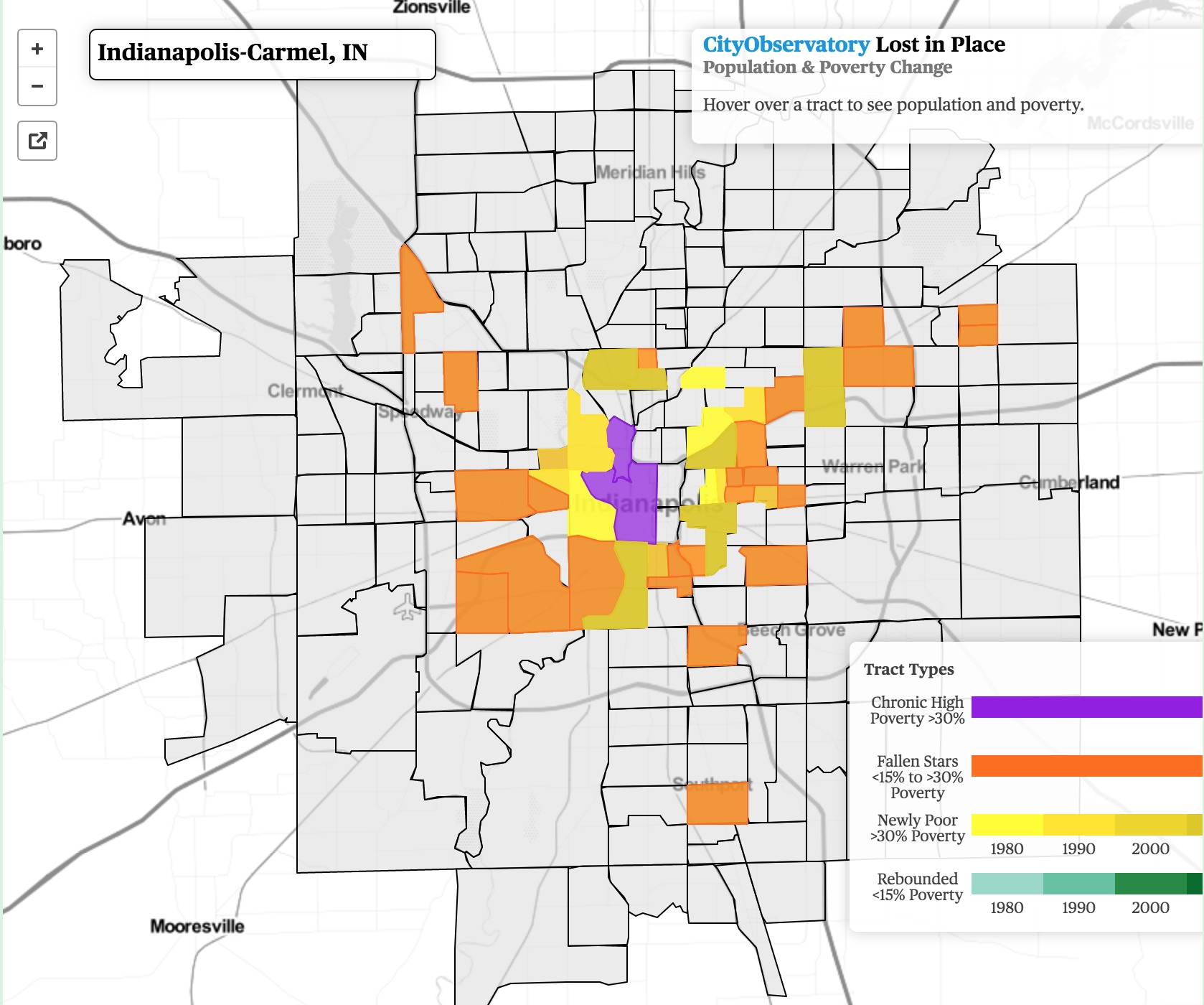

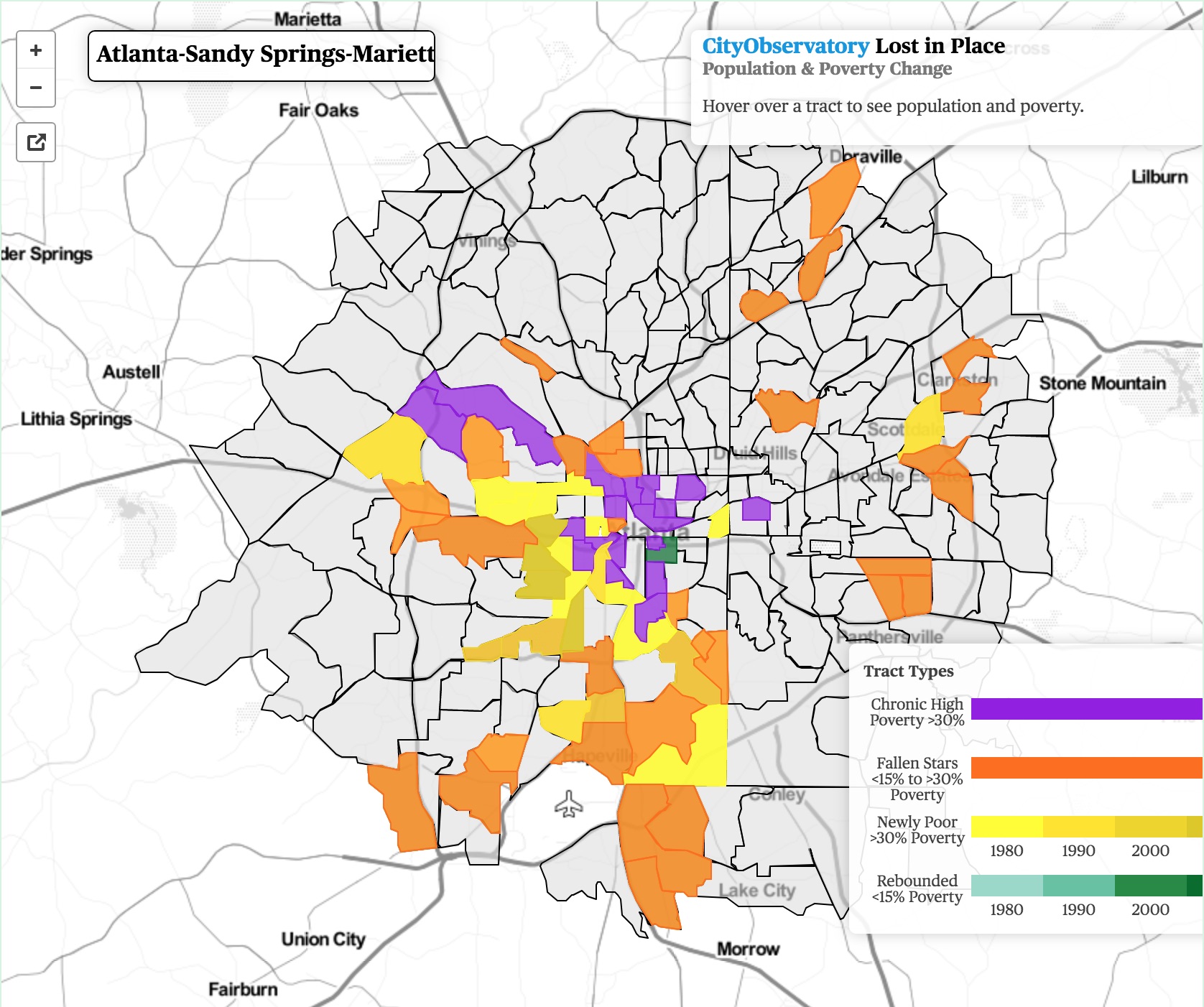

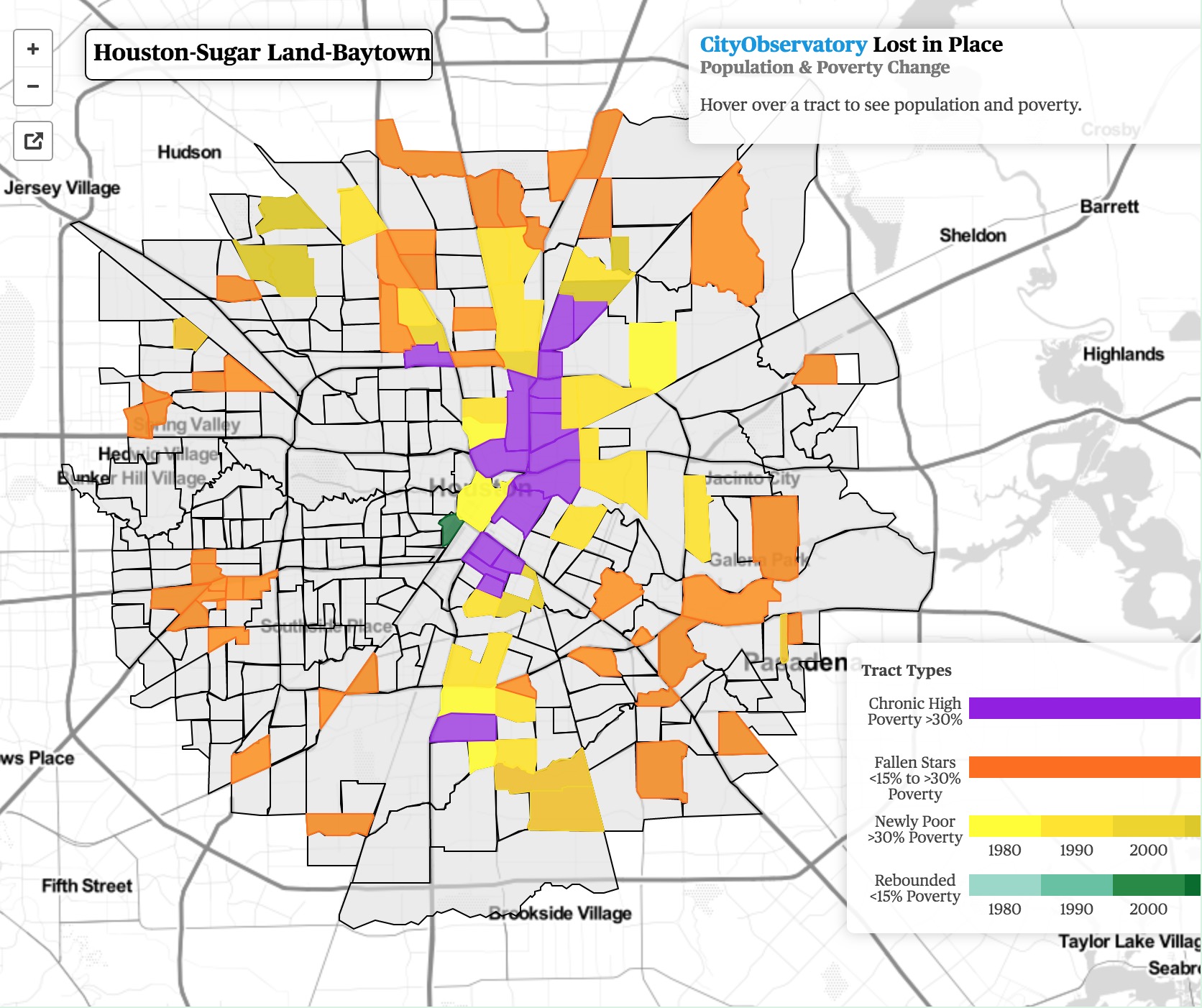

Our friends at City Observatory released an interactive report called Lost in Place that tracks neighborhood change from 1970 to 2010. Pick a region you're familiar with and pull up the map of it here. Look at the "fallen star" neighborhoods. Those are places that have gone from low poverty to high poverty in a generation and a half. Here's a slideshow of three example metros (you can find a lot more by visiting the link above)—Indianapolis, Atlanta, and Houston:

Your local tax base is most likely dominated by property taxes, and although real estate can't up and move, it can lose value. Sometimes a lot. Property values are a prediction, an expectation about the future of a place. See how they fare when the school system declines, the roads start to crumble, and people of means move out of the community. This fate is, if anything, even more likely for suburban communities whose primary selling point is precisely their shiny newness.

This analysis is limited by the fact that the comparison is only to 1970. If you really wanted to see some dramatic reversals of fortune, you'd look at the places that were clusters of concentrated affluence even earlier. Many, maybe most, of them are no longer their respective regions' prestige ZIP codes. How many poor neighborhoods are dotted with quite literally the luxury housing of, say, the 1880s?

If your path to long-term solvency relies on being a prestige ZIP code forever, I might suggest you develop a plan B.

Detroit, MI. Source: Juan N Only via Flickr.

Source: Baltimore Heritage via Flickr.

2. The return-on-investment of public spending is often highest in poor neighborhoods, not rich ones.

Strong Towns president Chuck Marohn made some waves in 2017 with an article entitled "Poor Neighborhoods Make The Best Investments." I'll let him summarize it in his own words:

This map of Lafayette, Louisiana, based on research conducted by Strong Towns and geoanalytics firm Urban3, illustrates that the city's lower-income neighborhoods, on balance, deliver a higher return on public infrastructure investment, while many of its wealthier areas are money-losers.

What is obvious here is that the poor neighborhoods are profitable while the affluent neighborhoods are not. Throughout the poor neighborhoods, the city is—TODAY—bringing in more revenue than they will spend to maintain the neighborhood....

This might strike some of you as surprising, yet it is important to understand that it is a consistent feature we see revealed in city after city after city all over North America. Poor neighborhoods subsidize the affluent; it is a ubiquitous condition of the American development pattern.

Of course, the reason for this isn't that, through some voodoo, these neighborhoods are magically producing more tax revenue per resident. Rather, value per acre is where they tend to shine. Poor neighborhoods usually have a more sustainable ratio of public infrastructure obligations to private wealth, even despite the lack of private wealth in these places.

Much of that is because 20th-century suburbanization left behind poor people in the places with a traditional development pattern. So it's not some ironclad law of economics that poor neighborhoods are more financially productive. What is actually the case is that the productivity advantage of the traditional development pattern is so dramatic that it actually outweighs the advantage of having wealthier residents and more expensive property.

Our distant ancestors built Rome and Jerusalem and Xi'an and Teotihuacan. Our more recent ones Kyoto and Buenos Aires and Paris and Marrakesh, and many more of humanity's timeless cities. And most of them did it not through vast infusions of wealth, but through many average citizens working incrementally. You don't have to be wealthy by modern standards to create a great place and maintain it. The genius of the traditional development pattern is exactly that: your place has the potential to thrive in the future even if the people living there then are of modest individual means.

3. Your suburban town probably can't afford its development pattern even if it is rich.

Here's a common sense observation: There is a limit to the amount of public obligation we can take on. And that limit is separate from any question of short-term cash flow or debt financing—i.e. the ability to write the checks today and have them clear.

Reductio ad absurdum: Suppose we built Elon Musk's Hyperloop and connected every city over a million people in the U.S. to the system. Could we afford to do it? If someone were willing to lend us trillions of dollars, sure, in a sense we'd be able to "afford" it: we'd have a loan through which we could pay contractors to make construction happen. Would it be a good idea? No. It'd be completely insane.

So we should all be able to agree there is a theoretical limit on the amount of infrastructure we can afford per capita. This is obvious and trivial. What we're arguing about is where the line is between affordable and not affordable, sustainable and not sustainable. Crucial to the Strong Towns argument is that the line isn't where you think it is.

We've been living so long with an illusion of wealth that we assume, "We must be able to afford all this stuff we've built, because it exists."

Reductio ad not-so-absurdum: If the state of Georgia wanted to double its road network, and someone were willing to lend the Georgia DOT the money to do it—backed by promises that the new capacity would unleash a virtuous cycle of economic growth and the investment would pay for itself—it could do so. If the debt financing were available, humans could be put to work building those roads, and then they'd exist.

I bet most readers will agree that this would be over-the-top. That wave of economic growth wouldn't materialize, because road spending doesn't really create much prosperity; it just tends to move it around by enabling people to live and work in new places and commute longer distances. Georgia would be stuck with a lot of expensive pavement in need of eventual maintenance.

Georgia currently has an estimated 271,000 lane miles of public road. The cost of a new road is highly variable but let's go with a lowball estimate of $1 million per lane mile. The state could double its existing road network for the low, low price of $271 billion. Divided over 30 years (a reasonable estimate of the lifespan of a road) and 10.43 million current Georgia residents, that's $866 every year for 30 years for every man, woman, and child in the state of Georgia. (Note for the nerds in the crowd: Yes, this is extremely simplistic in countless ways—it's a thought experiment, not a fiscal analysis.)

That's just roads: what if we also doubled the extent of sewers, water mains, pump stations, treatment plants, sidewalks, and so forth? And keep in mind the state has still got to maintain all of the stuff it's already built.

The thing is, this isn't actually that preposterous. Because we have done it before, and in a place without Georgia's booming growth. As Jason Segedy points out, Cuyahoga County, Ohio—home to Cleveland—more than doubled its built footprint from 1948 to 2002, while its population ended up being exactly the same in both years: 1.39 million.

Cleveland built a whole new Cleveland for no net new residents. And we wonder why we're going broke.

Suburban Atlanta can be smug and say, "But Cleveland is a Rust Belt city. It's been in decline for decades. We're growing."

Oh yeah? For how long are you going to keep that up? What happens when you don't grow?

So let's lay to rest the excuses of those who claim that the math about the unsustainable cost of infrastructure under the suburban development pattern doesn't apply to them:

"No one would lend us this money if it weren't a good investment."

"We wouldn't take on this debt if it weren't a good investment."

"Our growth itself is proof that we're doing something right."

"Well-to-do people keep moving here, so we must be doing something right."

"A government budget isn't like a household budget. We take on debt today in order to spur the economic activity that will pay down the debt tomorrow."

Sure, some municipal investments do pay off multiple times over—but the onus is on the government to do a rigorous cost-benefit analysis, absent the hand-waving that typically accompanies assertions that new spending is an investment in growth.

This isn't a small-government argument. It's actually agnostic to the normative question of how small or large local government ought to be. If you, the residents of an affluent community, want to tax yourselves more to invest in your quality of life, go for it. But can you back out of that obligation if your circumstances change?

Infrastructure is perilous because it's physically permanent. Cannibalizing your future tax base, via TIF or another means of jump-starting development right now, is perilous. When you commit your children's generation to paying for something you built, you need to think differently about that decision: because you don't know their situation, or even who will be living in your city then.

Carmel, Indiana. Source: Goodfreephotos.

Carmel, Indiana, had $1.2 billion in public debt as of 2017. The city has gone on an above-and-beyond municipal spending spree in recent years—road projects, civic buildings, a New Urbanist downtown out of thin air—in a bid to be Indianapolis's premier suburb. It has vociferous defenders who claim the debt is not a problem, because it's all backed by future revenue streams.

Let's unpack "future revenue streams." I take that to mean taxes that will come in over the coming years under existing projections: that property values will remain high and Carmel will remain Indianapolis's premier suburb.

But the track record of 1970's or 1990's premier suburbs being 2018's premier suburbs is spotty at best. So here's my question: would the defenders of Carmel's high public debt be sanguine about it no matter who was living in Carmel? Or if Carmel's per capita income were just over the poverty line, would louder voices be calling for the heads of its municipal leaders for mismanagement of the city's finances?

The answer is telling. If your growth strategy only works as long as wealthy people live in your town, your growth strategy is deeply fragile.

(Cover photo: Wikimedia Commons.)

Daniel Herriges has been a regular contributor to Strong Towns since 2015 and is a founding member of the Strong Towns movement. He is the co-author of Escaping the Housing Trap: The Strong Towns Response to the Housing Crisis, with Charles Marohn. Daniel now works as the Policy Director at the Parking Reform Network, an organization which seeks to accelerate the reform of harmful parking policies by educating the public about these policies and serving as a connecting hub for advocates and policy makers. Daniel’s work reflects a lifelong fascination with cities and how they work. When he’s not perusing maps (for work or pleasure), he can be found exploring out-of-the-way neighborhoods on foot or bicycle. Daniel has lived in Northern California and Southwest Florida, and he now resides back in his hometown of St. Paul, Minnesota, along with his wife and two children. Daniel has a Masters in Urban and Regional Planning from the University of Minnesota.