Oh, the Bureaucratic Inertia Outside Is Frightful

Editor’s Note: Michel Durand-Wood is a Strong Towns member in Manitoba, Canada who writes about infrastructure and municipal finance at Dear Winnipeg. This article first appeared on his blog before Christmas, but we felt it was too brilliant not to share…Christmas references and all. We’re even leaving in his invitation to fellow Winnipeggers at the end because we love how he invited neighbors to #DoTheMath and join him in speaking up at City Council. For more Strong Towns content by Durand-Wood, check out these articles:

Dear Winnipeg,

We need to talk. [It’s not you. It’s me.]

[No wait, it’s not me either. It’s City administration.]

[Sorry, I hope you didn’t think we were breaking up! Oh no, you won’t get rid of me that easily!]

Look, I’ve always known that things tend to move slowly at City Hall, but things are getting absolutely absurd.

Wait, could it be that some of you are not acquainted with the story of Rudolph, er, I mean City administration? Well pull up an ice block and lend an ear.

You see, this past Friday marked two years since I started writing to you and engaging with City Council on a regular basis. [Happy Anniversary everyone!]

But in October of 2019, over one year ago, I made a presentation to City Council regarding the new version of their Financial Management Plan.

I argued that while the plan did a good job of outlining financial targets for keeping our debt manageable and sustainable, it completely ignored them for infrastructure.

The underlying assumption seemed to be that more infrastructure was always better.

But that’s clearly insane. We obviously can’t afford “infinite infrastructure”. Especially since infrastructure comes with a promise to maintain and eventually replace it. Again and again. Forever.

And I had support from the latest City report on our Infrastructure Deficit, which said this:

Going forward, the City will have to consider a variety of strategies in order to effectively address the infrastructure deficit. […]

Apply an Affordability Lens to Policy Development and Long-Term Strategic Plans: Ensure guiding policies, such as OurWinnipeg, and service strategic plans, such as the Transportation Master Plan, consider what the City can afford.

City of Winnipeg 2018 State of the Infrastructure Report, page 15.

And based on the proposed Financial Management Plan, not only were we not considering infrastructure affordability, we weren’t even measuring it. We calculated our debt limit, so shouldn’t we find out what our “infrastructure limit” is, and how close to it we are?

Council agreed. They sent the report back to be revised. The system worked!

[They say that my heart grew three sizes that day!]

Nearly five months later, the newly-revised plan came back to the Finance Committee.

But without a measure of affordability for infrastructure… [Sigh.]

But, the brave members of the Finance Committee persevered. They directed the public service to go back, yet again, and to return with a measure of affordability for infrastructure, one that considers the entire life cycle costs of owning that infrastructure.

[That should do it, right?]

So here we are now, another nine months later. And that report is coming back to the Finance Committee for review!

But without a measure of affordability for infrastructure… [Double sigh.]

According to the report:

The dollar amount of investment in infrastructure that may be considered appropriate or sufficient is going to be subjective and vary from person to person depending on their preferences. […]

It might be suggested that the appropriate level of infrastructure investment is the one that is determined via the democratic will of residents that is ultimately reflected in the decisions made by City Council.

Lifecycle Costing for Infrastructure Investment Report, page 5

In other words, apparently, there is no upper limit to what we can afford for infrastructure. It’s simply a matter of personal preference.

But if that were actually true, what’s preventing us from phoning up the Province to let them know we’d like to be put in charge of building and maintaining all the province’s schools and hospitals? Don’t worry Mr. Pallister, money is of no importance — our public service tells us it’s simply a matter of personal preference. And while you’re at it, put the City in charge of all the provincial highways too. We prefer it.

Well, son of a nutcracker. When we put it that way, it sounds outrageous to believe we can afford infinite infrastructure, doesn’t it?

And if we accept that, then we are saying there is a maximum that we can afford. And if there is a maximum, then what is it?

Well since City admin refuses to, let’s measure it ourselves!

[Warning: very simple math ahead.]

Ok, let’s assume a City where we spend 100% of our revenue, all of it, every red cent, on infrastructure.

On page 3 of the report, we are told that “up-front capital investment […] only accounts for approximately 20-25% of the lifecycle cost of owning and operating an asset”.

Good to know. Let’s be conservative and use the cheaper 25% then.

Lastly, how long is the lifecycle, on average? Well, our 2019 Financial Statements show we are depreciating our infrastructure at an average rate of about 3.8%, which is a lifecycle of about 26 years.

So let’s put that all together: 100% of revenue X 25% / 3.8% = about 650% of revenue. In other words, we could sustainably afford infrastructure valued at 650% of our total revenue, if we spent all of our revenue on infrastructure.

In 2019, our total revenue from all sources (taxes, fees, water and sewer charges, transfers from the Province and the Feds, etc.) was $2.14 Billion. (page 36)

So, $2.14 Billion x 650% = $13.9 Billion.

We can sustainably afford $13.9 Billion of infrastructure.

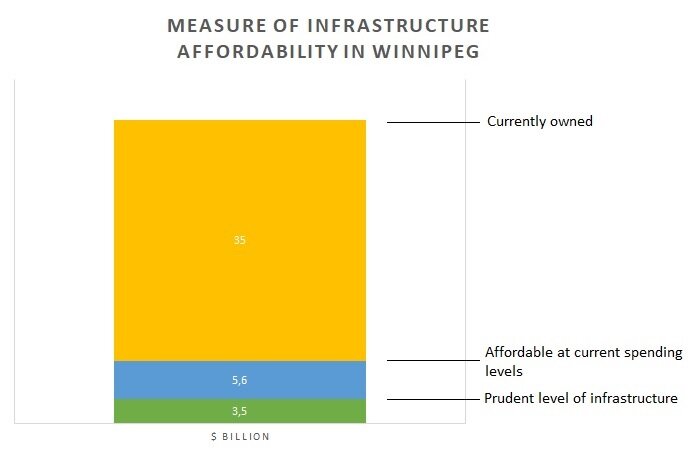

I don’t want to freak you out, but we currently own $35 Billion. (page 5)

Only we aren’t saying fudge.

Wait, it gets worse. On top of that, this is a theoretical absolute maximum if we spent ALL of our revenue on infrastructure. In practice, we can’t spend all of our revenue on infrastructure. At the very least, we need a few accounting clerks to collect and record our taxes. And we’ll likely still want at least a few bare bones services like garbage pickup and some sort of fire protection, so that’ll take some more funds away for that. How much? Now that’s actually a matter of preference.

But we can look to other cities to see what the norm is. According to data in our debt strategy, the average Canadian city was spending about 25% on capital expenses.

Okay, let’s do that calculation again: 25% of revenue X 25% / 3.8% = about 165% of revenue.

So, $2.14 Billion x 165% = $3.5 Billion.

Yikes. That means we have ten times more infrastructure than we can sustainably afford. And we wonder why we’re going broke?

Just for Ss & Gs, let’s do it one more time, but now using our actual capital spending levels. In 2019, we put $872.8 million into capital spending (page 9). That’s equivalent to about 40% of our revenue. Plugging that in gives: 40% of revenue x 25% / 3.8% = about 260% of revenue.

So, $2.14 Billion x 260% = $5.6 Billion.

This is not looking good.

Hey, maybe the public service doesn’t like our assumption about the length of the lifecycle being 26 years. Okay, then. Looking at it another way, at current capital spending levels, we are on track to replace our infrastructure on an average cycle of once every 164 years.

That means infrastructure built in 1873 when the City was incorporated wouldn’t technically be due for replacement for another 17 years.

That can’t be right either.

So what does it all mean?

Here’s a graph of the City’s Net Financial Position from my last letter:

This number goes down whenever we spend more on infrastructure than we make in net surplus revenue. It means we’re dwindling our cash reserves, taking on debt, or both.

To keep it under control, we have three options: increase revenue, defer maintenance, and/or cut services.

Over the past decade, we’ve increased our revenue (from $1.35 Billion in 2010 (page 26) to $2.14 Billion in 2019), through nearly record levels of population growth, adding over 100,000 new taxpayers.

Through deferred maintenance, we’ve also left a lot of our infrastructure to rot. [Hello, Louise Bridge anyone?]

And anyone who’s paid even the slightest attention to our annual budget processes knows that we’ve continued to cut services every year for a long time now.

Yet despite all that, our Net Financial Position continues to get worse.

Even though this figure has been able to go into the negative by nearly $850 million as of last year, making the City technically insolvent by definition, it too has a lower limit. It can only continue to go down as long as we have cash reserves on hand, and space left under our debt ceiling. But eventually, we run out of cash, and we hit our debt limit.

At the current rate of decline, that puts us about 12 years away from that nightmare scenario.

And what happens then? I don’t know. I guess we’ll be forced to go from “difficult” budget decisions to impossible ones.

But it doesn’t have to go that way. Winnipeggers aren’t dumb. We CAN handle the truth. But we need all the information. We need to know what we can afford, because preferences change when prices are attached. The support for a project like the Chief Peguis Extension might evaporate if it meant a 20% property tax increase.

We do it for debt, and we need to do it for infrastructure, because not doing it is literally bankrupting us. Balanced budgets, infrastructure priorities, property taxes, all of it, it all starts here. If we can understand this, then we can begin to understand why it’s become impossible for us to have nice things.

And so, I am going back to Finance Committee on Tuesday (over Zoom) to convince Councillors for a third time that we need to direct the public service to measure this.

I don’t mind doing it alone. But I could use some support. After all, I won’t be alone to feel the repercussions in 12 years.

So I am doing something today that I don’t usually do. In addition to the usual invitation to talk to your friends, family, colleagues, and Councillor about things you find interesting here, I hope you’ll join me in speaking up about this particular issue through the formal Committee process.

You don’t have to make a presentation if you’re not comfortable (although if you are, that would be great).

All you need to do is to email the City Clerk voicing your support for an affordability metric for infrastructure, as per item #5 of Tuesday’s Finance Committee agenda. It doesn’t have to be complicated, even one or two lines is enough. You can even link to this letter if you want. The email address is cityclerks [at] winnipeg.ca and you need to get it in before 4:30pm on Monday, December 7th, 2020.

Then share this with your friends, family, colleagues, and Councillor, and ask them to do the same.

Warmest regards,

Elmwood Guy

Cover image by Soumyasree Ghosh on Unsplash

About the Author

Michel Durand-Wood lives in the Winnipeg neighborhood of Elmwood with his wife and three children. He writes at DearWinnipeg.com, a really fun blog about infrastructure and municipal finance. He has no formal training or education in city planning, municipal finance, infrastructure maintenance, or anything else he talks about. He's just a guy, in love with a city, asking it to make better use of his tax dollars.

Every few years, the American Society of Civil Engineers releases its Infrastructure Report Card. Let’s be clear about what this report card actually is: industry propaganda, not unbiased analysis.