All Ponzi schemes fail. The question isn’t if, but when. A Ponzi scheme requires a never-ending stream of new investors to repay old ones. It can be kept alive only as long as the mirage of wealth can be maintained. Ultimately, a Ponzi scheme is a house built on sand; at some point, the investors dry up or the ruse does. And the fallout can be catastrophic, as with Bernie Madoff’s decades-long fraud, which had thousands of victims who collectively lost billions.

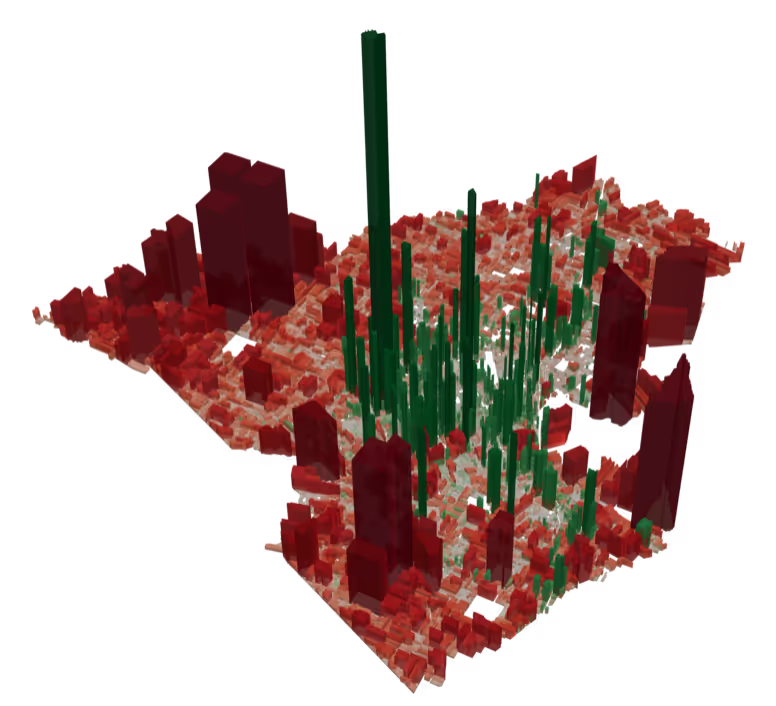

One of the early insights of the Strong Towns movement was that the way North American cities have been built since World War II resembles, more than anything, a massive Ponzi scheme. For several generations, towns and cities in the United States and Canada have aggressively pursued a form of growth—expansive, expensive, unproductive—that doesn’t come anywhere near to paying for itself. We must use new growth today to pay for the most urgent obligations of yesterday’s growth. The maintenance backlogs for all those bridges, pipes, and new roads swell. The unfunded infrastructure liabilities of U.S. cities is measured in the trillions, and the conventional plan for dealing with it—or, rather, not dealing with it—is to grow even more.

That there might be a disruption to growth—in the form of, say, a foreclosure crisis or a worldwide pandemic—is an idea too uncomfortable to entertain. A busted Ponzi scheme isn’t the only metaphor that comes to mind here. It’s the kid sprinting down the street on his bike, carefree as can be, until someone throws a stick in his spokes.

There’s a major difference between a Ponzi scheme perpetrated by someone like Bernie Madoff and what we at Strong Towns call the “Growth Ponzi Scheme.” And it’s this: we don’t think the people in your City Hall are fraudsters. No one is being nefarious. This is just the status quo approach every one of us has inherited. While the North American development pattern is about five-minutes-old in the long history of city building, it’s all any of us have known.

Few of the people who first undertook this continent-wide experiment—the same generations that lived through the Great Depression and survived a global war—ever foresaw the consequences. Alas, that doesn’t exempt us for examining the consequences in hindsight. Quite the opposite. What’s at stake is not simply preserving “the good life” for us and for future generations, but basic solvency. I’m reminded of a conversation in Ernest Hemingway’s The Sun Also Rises:

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

All Ponzi schemes fail, because they are built on illusions; there is no there there. What happens when an entire continent of towns and cities drifts toward bankruptcy? We may be finding out.

What follows is a step-by-step crash course on the Growth Ponzi Scheme—emphasis, I hope, not on the “crash.” If the Growth Ponzi Scheme is a new concept to you, it’s likely you’ll never see your city the same way again. (For me, the experience was comparable to a veil being lifted.)

In Step 1, you’ll get an overview of the Growth Ponzi Scheme from Strong Towns founder and president Chuck Marohn. Step 2 will take you deeper. Chuck provides more detail on the historical origins of the Growth Ponzi Scheme, its mechanics, and the data that reveals the cracks in the foundation.

In Step 3, you’ll find case studies from several towns and cities around the U.S. The Growth Ponzi Scheme isn’t an abstract concept. It is playing out in real-time all around us. Remember, these communities—Kansas City, Missouri; Lafayette, Louisiana; Spokane, Washington; Cobb County, Georgia; Collin County, Texas; and Detroit, Michigan—aren’t outliers: they are indicative of what’s quietly unfolding in towns and cities of every size and in every region.

But it wouldn’t be adequate—or fair—to diagnose the problem without also offering a plan to address it. There is a better way, and that’s what you’ll find in Step 4. It’s an approach that values resilience over efficiency, and incremental growth over huge, irreversible projects. Thousands of local leaders just like you—across the country and from all walks of life—are in the vanguard of this better way.

Step 1: Understand the Basics

Essential Reading: “America’s Growth Ponzi Scheme,” by Charles Marohn

The American pattern of development creates the illusion of wealth. Today we are in the process of seeing that illusion destroyed…and with it the prosperity we have come to take for granted. This short article provides an overview of the Growth Ponzi Scheme, and will lay the groundwork for what comes next.

[divider]

Step 2: Go Deeper

Essential Reading: “The Growth Ponzi Scheme,” by Charles Marohn (5-Part Series)

Most American cities find themselves caught in the Growth Ponzi Scheme. We experience a modest, short term illusion of wealth in exchange for enormous, long-term liabilities. We deprive our communities of prosperity, overload our families with debt and become trapped in a spiral of decline. This cannot continue.

- Part 1: The underpinnings of the foreclosure crisis lie in a living arrangement—the American pattern of development—that does not financially support itself.

- Part 2: If you want a simple explanation for why our economy is stalled and cannot be restarted, it is this: Our places do not create wealth, they destroy wealth.

- Part 3: Our development pattern is not productive enough to sustain itself, as we see when we follow a project over multiple life cycles.

- Part 4: Our national economy is "all in" on the suburban experiment. We cannot sustain the trajectory we are on, but we've gone too far down the path to turn back.

- Part 5: How did our ancestors build such amazing places? They built places that could financially sustained themselves. And this gets at the course-correction our towns and cities must make now.

[divider]

Step 3: Read the Case Studies

LAFAYETTE, LOUISIANA

Essential Reading: “The Real Reason Your City Has No Money,” by Charles Marohn

Lafayette has made promises it can’t keep. If they operated on accrual accounting—where you account for your long term liabilities— instead of a cash basis (where you don't), they would have been bankrupt decades ago. This is a pattern we see in every city we've examined. It is a byproduct of the American pattern of development we adopted everywhere after World War II.

Kansas City, Missouri

Essential Reading: “Kansas City’s Fateful Suburban Experiment,” by Daniel Herriges

Kansas City was once described as the “Paris of the Plains.” Today it is the freeway capital of America. A look at the city’s history of gobbling up land on its outskirts shows why Kansas City could be considered a poster child for America’s radical experiment in suburbanization.

Spokane, Washington

Essential Reading: “Dispatches from Spokane: Living a Soft Default,” by Spencer Gardner

Spokane is an excellent illustration of a “soft default.” Like virtually every other city in the US, it is functionally insolvent, but functional insolvency doesn’t always result in legal bankruptcy—just diminished services and deferred maintenance.

Cobb County, Georgia

Essential Reading: “Cobb County: Addicted to Growth,” by Rachel Quednau

“Like an addict whose use is spiraling out of control, these communities kept reaching for ‘just a little more growth’ and ‘just a few more development projects’ to get them through the next budgeting period, begging other sources (particularly at the state and federal level) for money to feed their habit.”

Collin County, Texas

Essential Reading: “A Texas-Sized Pavement Problem,” by Daniel Herriges

Collin County, Texas officials claim they need $12.6 billion for new roads in the next 30 years, and none of it for maintenance of what they’ve already built. That way lies madness.

Detroit, Michigan

Essential Reading: “We Are All Detroit,” by Charles Marohn

We want to dismiss Detroit as an anomaly. But in fact Detroit is a glimpse into the future for nearly every American city and town. Increasingly fragile from auto-centric development, for Detroit—and for the rest of us—it was only a matter of time.

[[divider]]

Step 4: Take Action Where You Live

Essential Reading: “What Should My City Do about Our Infrastructure Backlog?” by Charles Marohn

If your community has a huge backlog of unfunded infrastructure maintenance—and it’s the rare one that doesn’t—there are some basic and obvious steps that need to be taken. The first? Stop adding more infrastructure. “When you have a leaking roof, you don’t put an addition on your house. When your car engine is sputtering, you don’t upgrade the speaker system. This is an easy and obvious policy to enact; the only thing preventing it is the momentum of the current approach.”

Additional Reading: “10 Steps to Fix a City,” by Andrew Burleson

Each one of these actions marks a dramatic departure from the norm for most places. Take even one of these steps and your town is on its way to becoming stronger.

.webp)